We recognise that each investor has individual objectives. Palisade provides flexible access to unlisted infrastructure investments through pooled funds and tailored portfolios (individually managed accounts).

Our focus is Australian and North American infrastructure.

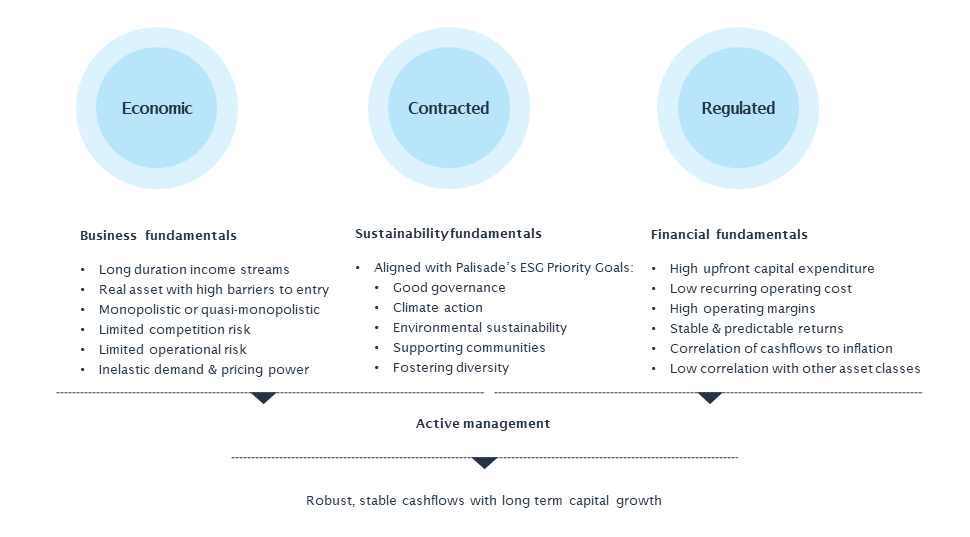

We focus on investment in mid-market infrastructure investments, minimising competitive pressure on asset prices. Investment across economic, contracted and regulated infrastructure assets can deliver robust and strong cashflows and capital growth if assets are managed actively. Unique business and financial fundamentals must exist to ensure infrastructure delivers appropriate risk adjusted returns to investors.

“Assets providing essential facilities and services necessary for the efficient functioning of economies”

Palisade uses a proprietary portfolio construction and risk management framework to deliver long term, stable returns for investors.

IMA

A tailored approach to individual risk and return objectives, with asset selection to an agreed strategy. Investors can access individual strategies and also co-invest with Palisade’s managed funds in target sectors.

Palisade’s Diversified Infrastructure Fund

Core exposure to Australian and North American infrastructure, diversified by sector, geography and asset maturity.

Palisade’s Australian Social Infrastructure Fund

Social infrastructure (PPP) assets with predominantly federal or state government availability payment revenue streams.

Palisade’s Renewable Energy Fund

Australian-based renewable energy assets (with ability to take some New Zealand exposure) – with a key focus on wind and solar projects.

Our investors are typically large and sophisticated investors, including:

- Australian superannuation funds

- Australian institutions

- Charitable foundations

- Sovereign wealth funds

- Offshore pension funds

For further information on any of our Funds, including a copy of our Information Memorandum please contact us.